It's all avocado toast and trips abroad?

Millennials have faced a series of criticisms over how they choose to live their lives and how that has affected their spending habits. Millennials have been constantly compared to previous generations and just how well we have done, as compared to other generations, in achieving the traditional life goals such as buying your first home, getting married, having children, purchasing your first car etc.

Being a millenial myself, I can sort of see where that comes from and have had “the money talk” with my parents several times. Many say we need to relook at our spending habits and consequently our savings habits. I have had quite the eventful week reading through articles and statistics produced on our spending habits and my conclusion was perhaps we need to do a double take on our finances.

Are millenials really that different?

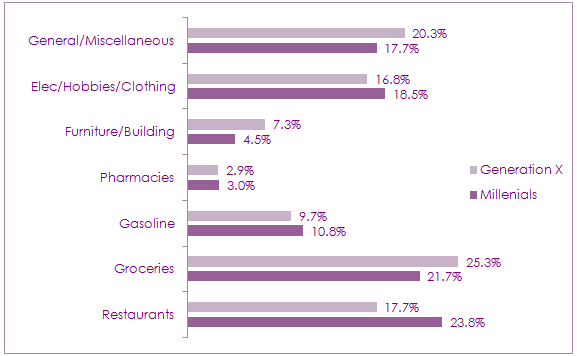

The research, at first glance, shows that we are not that far off from our parents who are Generation X. We spend more or less the same on medical care and pharmacies and gasoline. However, we spend about 2% more on electronics, hobbies and clothing than our parents do and about 6% more on restaurants. We also spend less on traditional household expenses like furniture, building and groceries than our parents do (almost 3% less on furniture and building and 4% less on groceries). But does this warrant the stereotype that millenials are irresponsible spenders with little to no care for savings? I do not think that we are that different, we just have different priorities?

Why are we different?

Several articles point to how we as millenials have shifted away from the importance of ownership of property and products and that we rather are focused on experiences, without the burden of ownership. For example, instead of buying a car and going through the hassle of financing and maintaining the car, we choose to make use of Uber or Lyft because it is just so much easier for us to use. There has been a lot of emphasis on us valuing multisensory experiences and seeking instant gratification regardless of the cost or giving in to the pressure to achieve traditional life milestones such as saving towards buying a home. In addition, the amount of technology we have access to has given us the opportunity to experience without ownership.

Technology has also offered us experiences that were previously considered life goals and unattainable for young people traditionally at much cheaper prices. For example, flights have become incredibly cheaper, more so for resort destinations around the world. In our age, it has become normal for someone to choose to spend months on end travelling because of the access to cheaper flights. This, coupled with our shift from traditional life milestones to experiences, has led us to be spending more on travel, high-end products bought online and less on more home making kinds of expenses such as furniture and groceries. According to Bank of Merryl Lynch, millennials spend more on restaurants, electronic devices, hobbies and clothing than any other generation before us. It also happens that we spend the least amount of money on groceries, furniture and buildings (we spend very little on home making it seems) than any of the generations before us. Perhaps that explains why we have been called the “experience” generation for how we focus more on experiences in our restaurant visits, our nights out and our electronic gadgets rather than on home making or buying groceries to cook at home.

How does the average millenial spend their money?

According to data collected by Strutt & Parker, the average spend of a millenial looks like the pie chart above. the average millennial has a budget of approximately £6,354 per annum. With that amount, we apparently spend close to 47% of that amount weekly nights out for the year. Coming in on a close second is a reflection of our love for restaurants and the increase in the number of foodies that have come with our generation. We spend approximately 21% of our annual budget on takeaways (I think we can blame UberEats and others for this right, definitely not our fault?). In our defence, technology has just made it 10000 times easier to get a meal than it was for previous generations, especially with the ability to make an order for food online and get it delivered for free of charge is just so much easier than going to buy groceries and then cooking to get a meal out of the groceries.

“We live for the coffee”

We have become an incredibly busy generation and one that seems to be addicted to coffee to keep up with the fast and ever changing world of technology. We need coffee so much that we spend close to 10% of our annual budget on coffee. I personally had not realised just how quickly that a medium latte from Costa Coffee a day could set me back that much in my budget. It turns out that that £2.45 a cup actually adds up to quite a lot at the end of the year.

We are the night lifers

It has been claimed that we spend more during the night than we do during the day. The reason for this? Our nights out clubbing and at high-end restaurants. We would not hesitate spending on experiences, bottles of alcohol and club entry fees. According to Strurr and Parker, each millenial on average spends £115 on one night’s clubbing. Whether this is true for everyone is debatable, but these are the results of their millenial survey. It is worrying though that this forms 47% of our annual budgets.

My takeaway

I do not think that the stereotype that we are heavy

spenders and bad savers holds much water. I just think that we are different in

terms of our priorities as compared to Generation X, but at the end of the day,

in money terms we are actually not that different. We still strive for

traditional goals such as having a home and buying groceries every month, but

that is not as much a priority for us as it was for our parents. We could

benefit though from some cost cutting measures, less nights out and less spent

on takeaways. Perhaps that would put us on par with previous generations?